The Official Website Of

Where Homeownership Dreams Come True

Top Rated

A trusted guide for first-time homebuyers. Rhodensia Gray’s First Time Homebuyers: Making Homebuying Easy offers essential advice for navigating the home-buying process with ease. Discover expert tips that help make your homeownership dreams come true!

Top mistakes first-time homebuyers make

If you have no money saved, you need to start at least 2 years before you want to buy, so you can save money. Start by building a savings account for your down payment or finding a local program that gives down payment grants.

Buyer quiz from the book

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry.

“Lorem Ipsum is simply dummy text of the printing and typesetting industry.” – Rhodensia Gray

Rhodensia Gray

- Lorem Ipsum is simply dummy text of the printing and typesetting industry.

- Lorem Ipsum is simply dummy text of the printing and typesetting industry.

- Lorem Ipsum is simply dummy text of the printing and typesetting industry.

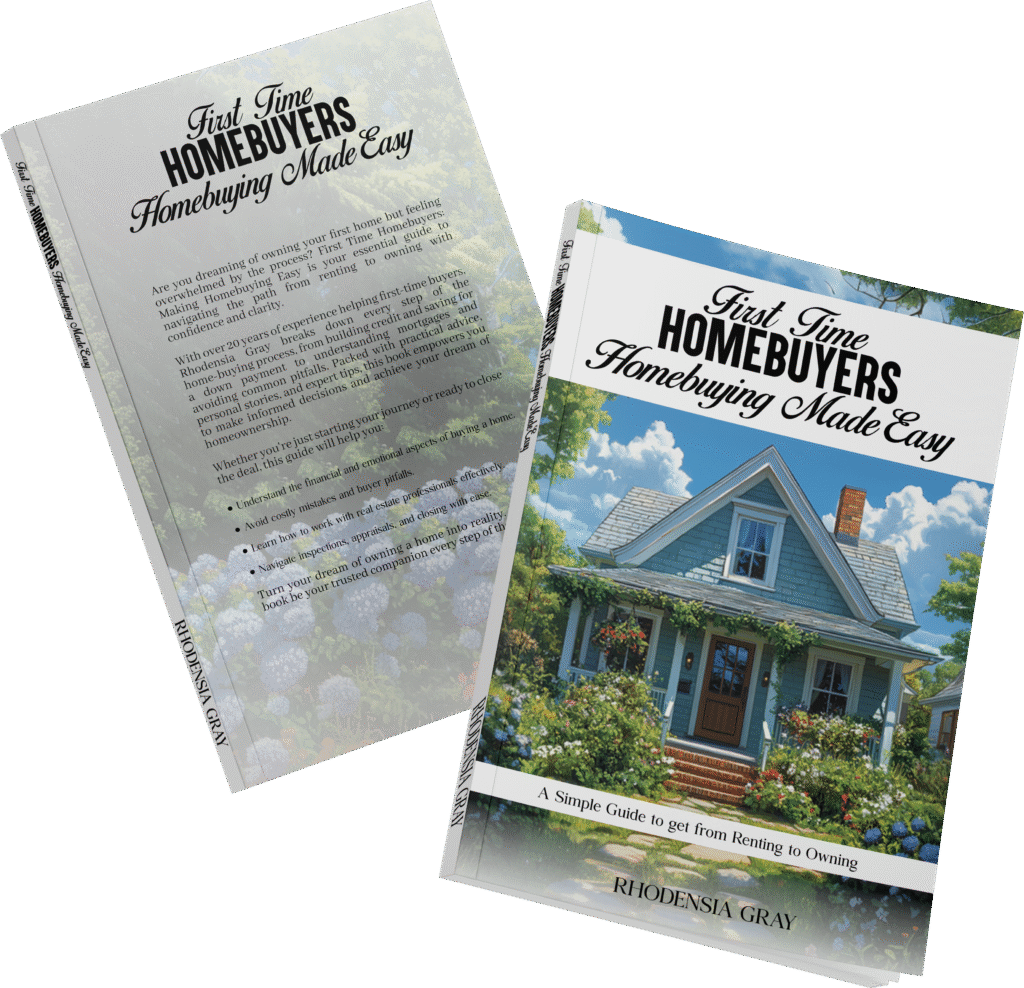

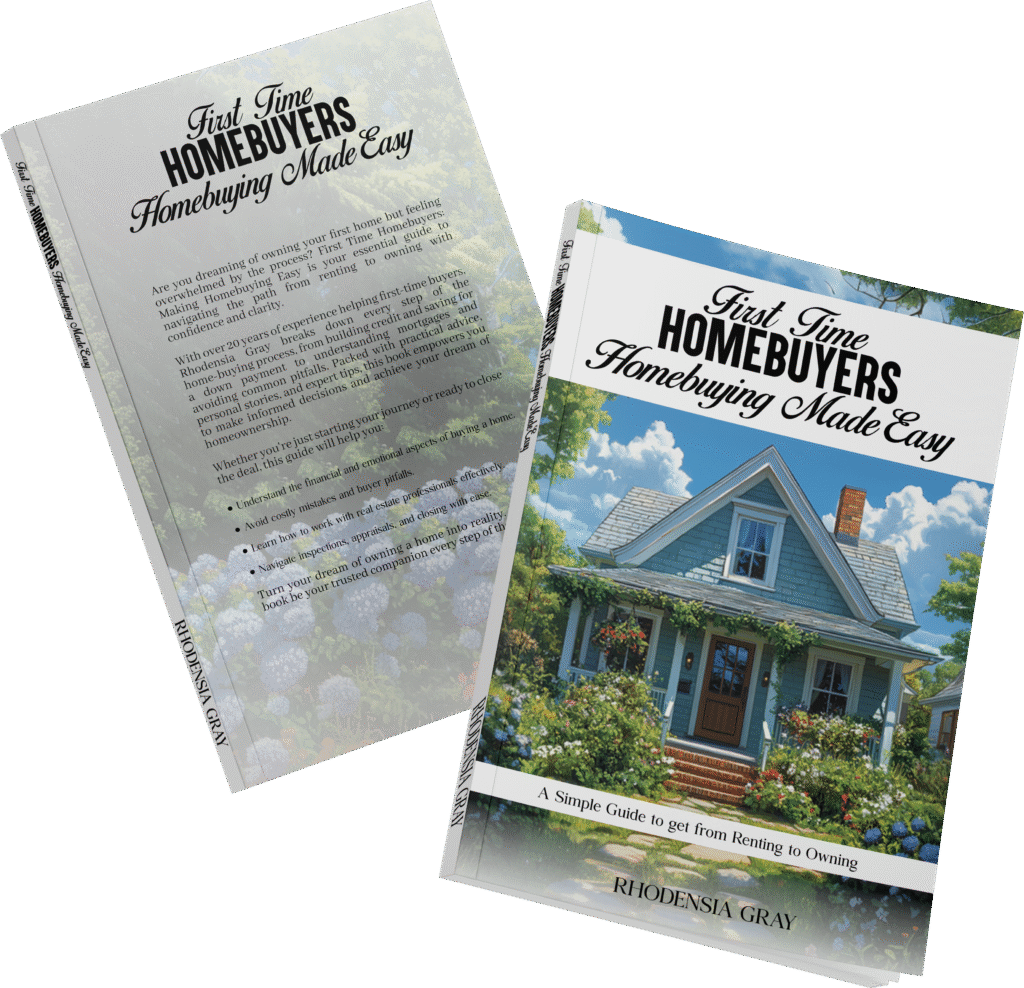

First Time Homebuyers: Making Homebuying Easy by Rhodensia Gray

Purchasing your first home can feel overwhelming, but First Time Homebuyers: Making Homebuying Easy is here to change that. Rhodensia Gray breaks down the complex process into easy-to-follow steps, offering practical advice and insider tips that will guide you from the first spark of interest to the final signature on the dotted line.

Whether you’re just beginning to explore the idea of homeownership or ready to make an offer, this book equips you with the tools you need to navigate the homebuying journey with confidence. Learn how to assess your financial situation, understand the various loan options, find the perfect home, and tackle the inspection process without stress. Gray also reveals helpful strategies for overcoming common obstacles and avoiding costly mistakes, making this a must-read for first-time buyers looking to make informed, confident decisions.

Packed with real-world insights, this comprehensive guide ensures you understand every step of the process and can make homebuying a rewarding experience, one step at a time.

Available On:

4.9

Rating On Amazon

650+

Copies Sold

On Amazon

Watch Trailer

On Youtube

About The BOOK

First Time

Homebuyers

Homebuying Made Easy

Chapter 1

Chapter 2

Chapter 3

Chapter 4

Chapter 5

Customer Reviews

Whats Our Clients Say

Latest Blogs

The Hidden Costs of Buying a Home: What First-Time Buyers Need to Budget For

While many first-time buyers focus on the price of the home itself, there are several hidden costs that must be factored into your budget.

First-Time Homebuyer Programs: A Guide to Down Payment Assistance and Grants

Saving for a down payment can be one of the biggest hurdles when buying your first home. Fortunately, there are...

Understanding Mortgages: What You Need to Know as a First-Time Buyer

A mortgage is a long-term commitment and an essential part of buying a home. Simply put, it’s a loan where the home serves as collateral.